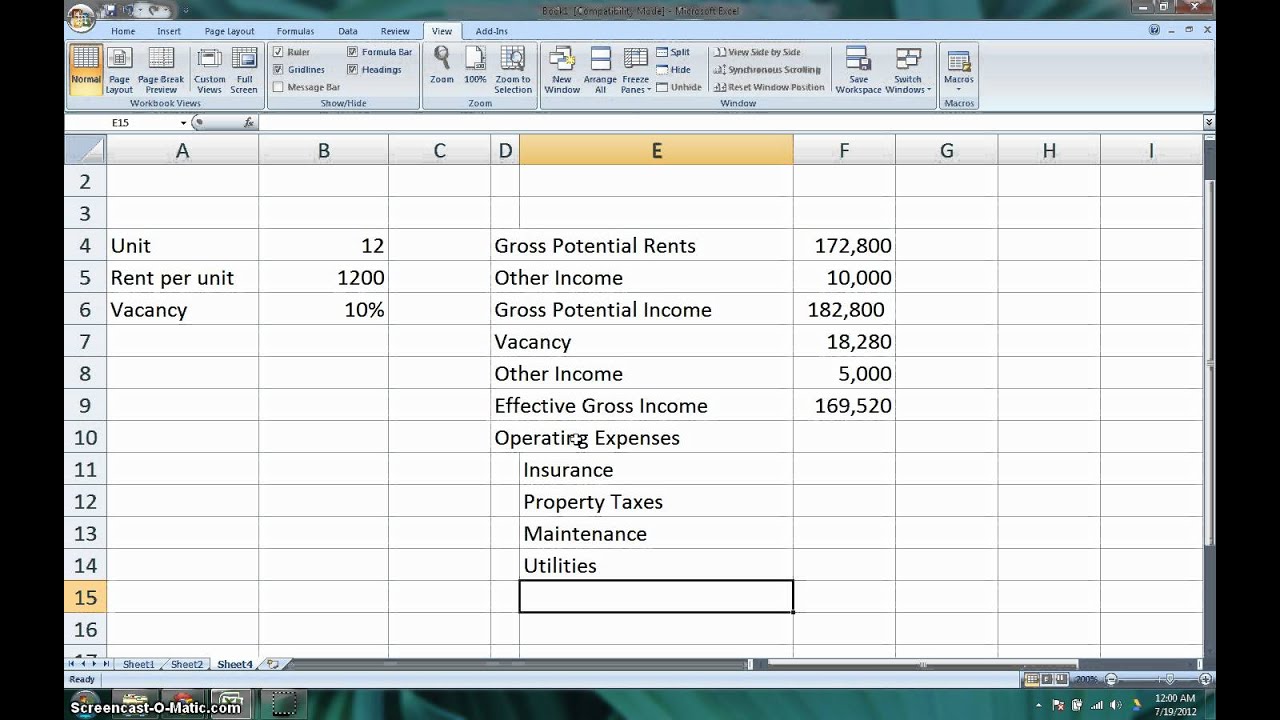

You should not have the idea that the analysis should not take into account the actual costs of the owner for the past period, and the projected average costs for the year following the date of assessment. By not including them in your calculations, you can exclude items that are different from the property and get more accurate results to compare potential rental investments. Net Operating Income = Gross Operating Income – Operating Expensesīe mindful that your net operating income calculation should not include your mortgage expenses. The Net Operating Income formula is simply: Next, according to the net operating income formula you need to cut down on your gross operating income from your property by the number of operating expenses. The typical list of operating expenses includes property management costs, utilities, staff salaries, payment for contractual services (telephone, fire protection system, elevator, etc.), insurance fees, maintenance and repair costs, tenant screening fees, legal fees, accounting and auditing services, pest control costs, entertainment expenses, etc. Typically, in the income statement, this calculation is announced at the end of the transaction section, calling it net operating income (NOI).įirst of all, you need to calculate the operating expenses you have. In other words, the net operating income formula is calculated as the amount of Gross Operating Income received from the appraised property after deducting all operating expenses. The cap rate is another metric in real estate investing which you calculate by dividing the NOI by the property’s value. Net operating income real estate is a calculation used to analyze the return on income-generating real estate investments. The higher the operating income over time, the more profitable the property would be. Then well have our net operating income automatically. Net operating income (NOI) is a key factor that should be calculated because it is considered a crucial indicator of performance. As shown above, we can enter in a few basic assumptions about the property to build a year 1 proforma. In the NOI sheet, calculate the Total Rentable Square Feet (RSF) by Unit Type in range F3:F7 by multiplying the.

#Property noi calculation spreadsheet how to#

Have you ever thought about the best way to figure out how profitable a potential rental property purchase could be? What type of tools do you use when you are looking at how to calculate net operating income for the property you’re considering for purchase? We’ve created a noi calculator that can take the stress out of the equation! Download and open the file named ExcelProject. How to Calculate Net Operating Income: NOI Calculator

0 kommentar(er)

0 kommentar(er)